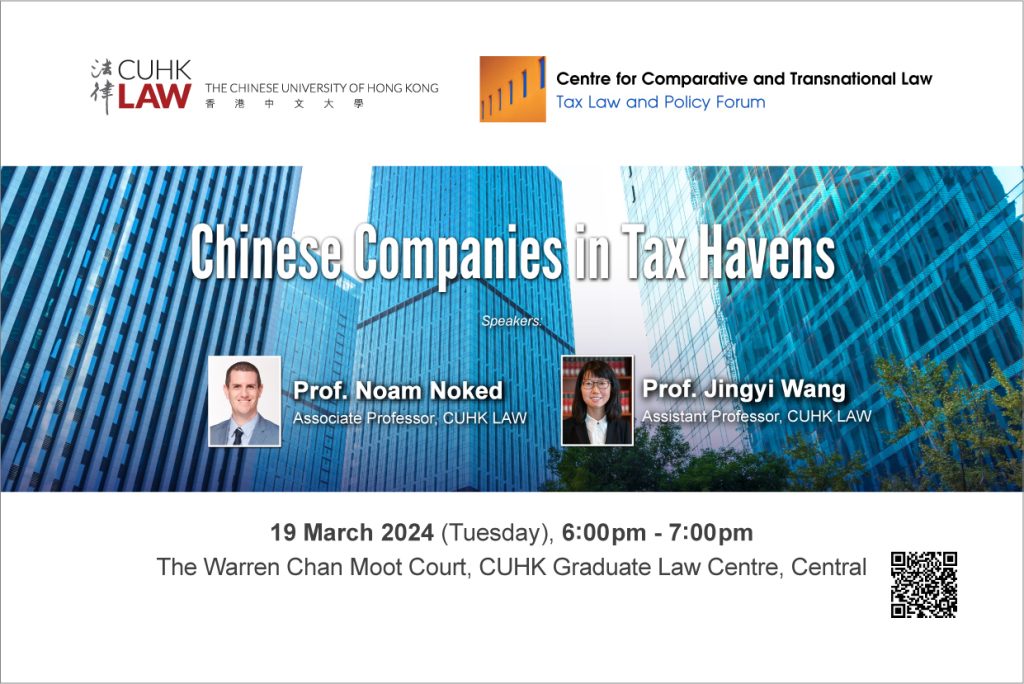

Alibaba and Baidu are frequently referred to as the “Chinese Amazon” and the “Chinese Google.” However, these companies and many other Chinese multinational enterprises (MNEs) take the position that they are not resident enterprises for Chinese tax purposes. This position has afforded these MNEs substantial tax advantages as they can accumulate untaxed profits in tax havens. This seminar will analyze the tax position of such Chinese MNEs from legal, empirical, comparative, and policy perspectives.

The speakers will examine the legal basis of this tax position and the advantages it provides. The speakers will present their analysis of the tax residence positions of the largest 80 Chinese MNEs with tax-haven-incorporated parent companies traded on major U.S. stock exchanges. Speakers’ comparative analysis will show how other large economies implement tax measures to prevent their companies from avoiding taxation in similar situations. The speakers will consider the expected implication of the global minimum tax on Chinese MNEs with tax-haven-incorporated parent companies. They will also explore potential reforms.

This seminar is jointly co-organized by the CCTL Tax Law and Policy Forum and International Fiscal Association – HK Branch.

About the Speaker:

Prof. Noam Noked, Associate Professor, CUHK LAW

Prof. Jingyi Wang, Assistant Professor, CUHK LAW

0 Comments